How to reconcile the labor distribution to the payroll register

This article discusses how to reconcile the labor distribution report to the payroll register for a company that is using a third-party, outside payroll system such as ADP, Paychex, Inuit Online Payroll, etc. It does not discuss this process when using Quickbooks Desktop payroll, which is the topic of a separate article.

The labor distribution is a process that allocates labor costs to jobs, service items, and general ledger accounts in Quickbooks. It is a process that is required for DCAA compliance. The allocation is based on the employees' timecards, which are either entered into Quickbooks or imported from a third-party timekeeping system. A mock payroll is run, which produces the labor distribution. Once the labor distribution is created, it is reconciled to the payroll register obtained from the third-party, outside payroll system. This article discusses the last step, the reconciliation of the labor distribution report to the payroll register.

Downloadable File:

Excel Worksheet to Reconcile Labor Distribution to Payroll Register

Step 1:

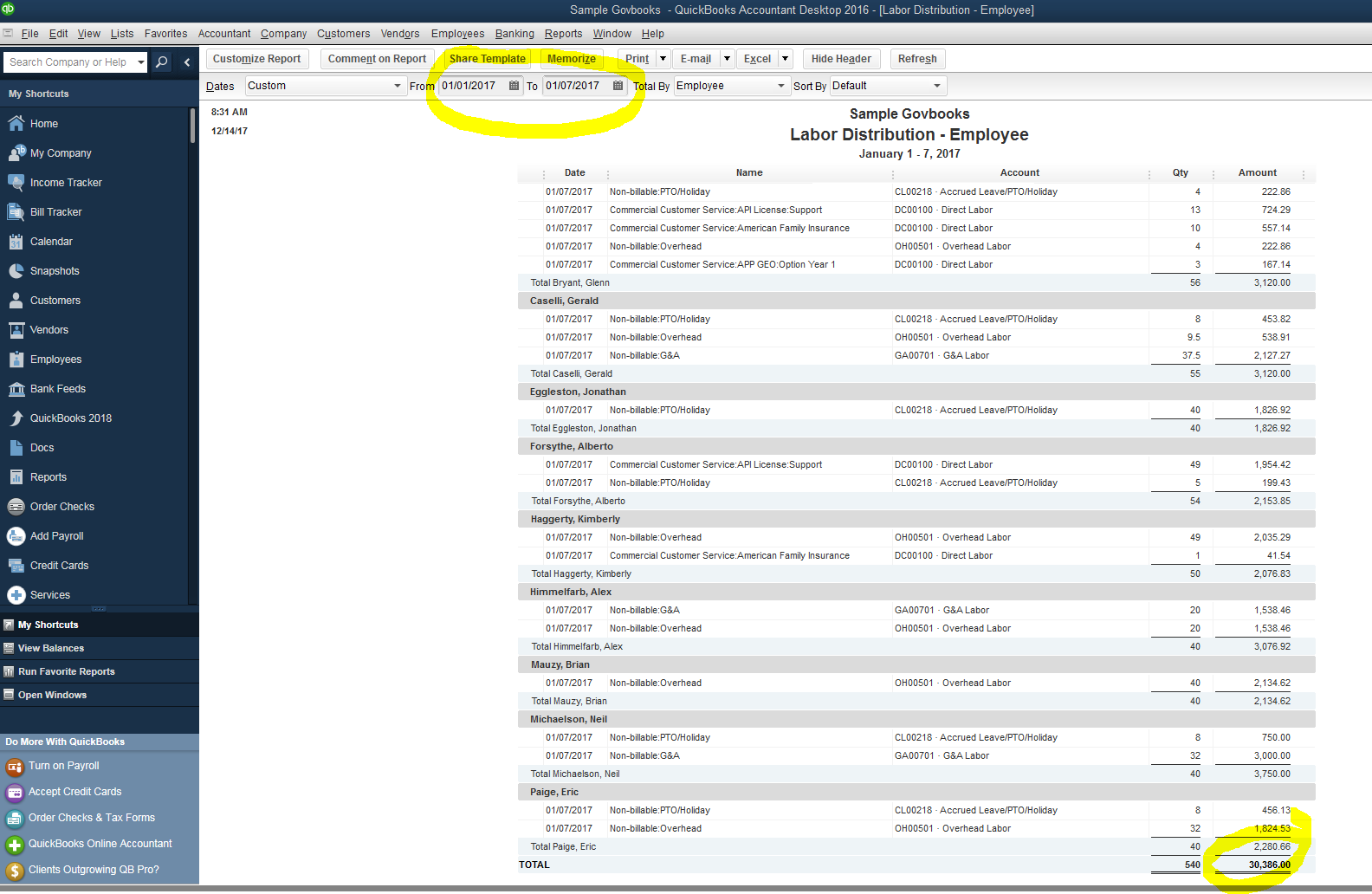

Select the "Labor Distribution Report by Employee" from the drop down menu in Quickbooks. You will find this report in the Memorized Reports folder and the DCAA sub-folder (the DCAA sub-folder is discussed in another article).

Step 2:

Set the date range to the beginning and end of the pay period which you will reconcile. Perform this reconciliation for every pay period the ends within the calendar month. (For companies that use Quickbooks Desktop payroll, you will need to adjust the dates to the pay date as the end date and the day after the last pay date for the beginning date). Note the total dollar amount at the bottom of the report. You will use this dollar amount to reconcile to the payroll register.

Step 3:

Compare the total dollar amount at the bottom of the labor distribution to the total gross wages on the payroll register. If the totals do not match (as in this case), you will need to identify the differences.

- Compare the payroll register detail for each employee to the labor distribution. Check to ensure that the same employees appear on both reports.

- Check that the gross pay matches. If you find a difference in gross pay, it may be that the employee received a pay raise which was not updated in Quickbooks and you may need to edit the paycheck in Quickbooks.

- You should also compare the number of hours on the Labor Distribution Report to the number of hours on both the timekeeping system and the Employee Time by Name report in Quickbooks to determine if the correct number of hours are recorded on the paycheck in Quickbooks; for hourly employees, the difference may be due to an incorrect number of hours on the paycheck in Quickbooks.

- Analyze how the gross pay is computed on the payroll register. The total gross pay on the payroll register may include items that are not included on the Labor Distribution Report. Only time sheet related charges should appear on the Labor Distribution Report. However, on the payroll register, non-time related items may be included in the total gross pay, such as a travel reimbursement, an expense report reimbursement, a salary advance, an internet reimbursement, a bonus and a commission. T his list is not exhaustive so there may be many more items which would cause a difference.

Step 4:

Complete the Payroll Reconciliation tab on your Month-end Closing Checklist (the Month-end Closing Checklist is discussed in another article).

- Create a column for each payroll with a pay period that ends within the month that you are reconciling and complete the following steps for each payroll.

- Enter the gross pay from the payroll register and the total dollar amount of labor from the Labor Distribution Report.

- Reconcile any differences by adding the amounts of the differences and an explanation to the reconciliation section.

- When the final differences are zeroed out, the labor distribution is reconciled to the payroll register.